We’ve identified communities where you will be safe and welcome, in States with low Income Taxes and where your vote will be a game-changer at the ballot box.Washington: My Home

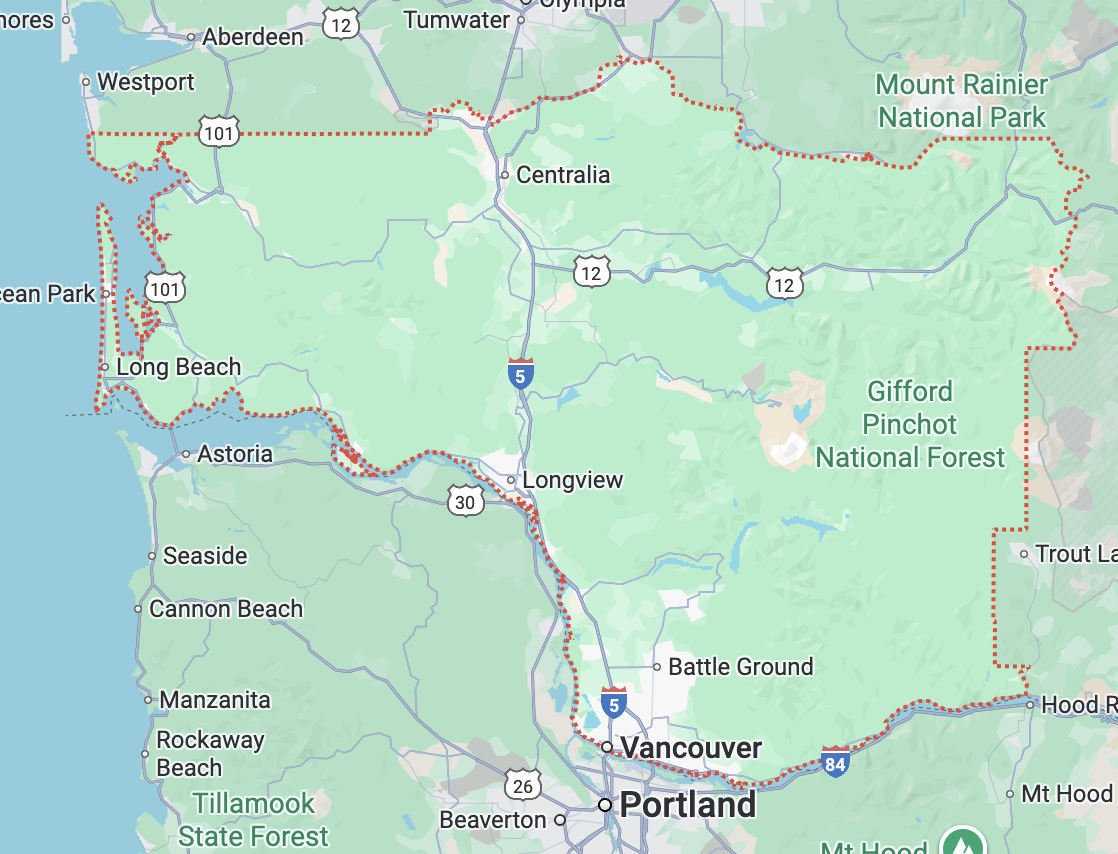

Washington: Congressional District 3

Living in Washington's 3rd Congressional District, which encompasses the southernmost portion of Western Washington, offers a diverse experience ranging from suburban hubs like Vancouver to rural, timber-influenced communities and coastal areas.

The lifestyle is shaped by its proximity to the Columbia River, coastal access, and mountainous terrain. Clark County, home to Vancouver, offers a more suburban environment with access to Portland, Oregon's amenities, alongside its own growing cultural scene, parks, and recreational opportunities. Further north and west, the districts become more rural. Residents across the district enjoy abundant access to natural beauty.

The climate in Southwestern Washington is characterized by warm, dry summers and cold, wet, and overcast winters.

The cost of living in the 3rd CD is generally higher than the national average. The median household income in the district is around $90,563. Homes in this region are often significantly higher than the national median.

Washington does not have an individual income tax, nor does it tax retirement income, including pensions and Social Security. However, it relies on a 6.50% state sales tax (which can reach over 9% with local additions) and property taxes, with an effective statewide rate of about 0.76%.

Washington has an estate tax but not an inheritance tax.

COMMUNITY SNAPSHOTS

Vancouver, Clark County

Vancouver Livability Stats:

Urban ● $$$ ● Schools: B ● Crime: C ● Community Health: Average ● Nearby Airport

Vancouver Homes for Sale and Rent

Living in Vancouver, Washington offers a unique blend of Pacific Northwest charm and a more relaxed pace of life than its larger neighbor, Portland, Oregon. It’s a place where nature is always at your doorstep, with lush green landscapes and proximity to mountains, beaches, and the Columbia River Gorge. While the Pacific Northwest is known for its rainy, gray winters, Vancouver’s beautiful, mild, and sunny summers more than make up for it. The city has a strong sense of community, with a growing downtown and waterfront area that provides a variety of restaurants, breweries, and cultural attractions, all within a more suburban and family-friendly atmosphere. A major financial benefit is the lack of a state income tax, which can be a significant savings for those who work in Washington. Though the cost of living is rising, it remains more affordable than in Portland, especially when it comes to housing.

The close proximity to Portland, Oregon, is a major draw for many residents, offering easy access to a vibrant cultural scene, diverse dining options, and major events. This "best of both worlds" lifestyle, however, comes with a significant drawback: the heavy traffic on the I-5 and I-205 bridges during rush hour, which can turn a short commute into a long one. Even with this challenge, many residents find the benefits outweigh the costs. The area's diverse and growing economy, with significant employment in healthcare and construction, provides opportunities, though many still commute to Portland for work. For those who enjoy a quieter, more outdoors-focused lifestyle with the amenities of a major city just a short drive away, Vancouver presents a compelling option.

Vancouver Tax Stats

Understanding the tax landscape in Vancouver, Washington involves looking at the state, county, and city levels, as well as the different types of taxes that apply.

State Level Taxes

Income Tax: Washington is one of a few states with no state income tax. This applies to both personal and corporate income. However, it's important to note that the state does have a 7% tax on certain long-term capital gains that exceed a high exemption threshold.

Sales Tax: The state of Washington has a baseline sales tax rate of 6.5%. This tax applies to most goods and services, with key exemptions for items such as groceries and prescription medicines.

Estate and Inheritance Tax: Unlike Florida, Washington has a state-level estate tax. The tax is progressive, with rates ranging from 10% to 20%. As of 2025, the tax applies to estates valued at over $2.193 million. This is a tax on the estate itself, not on the inheritance received by beneficiaries.

County and City Level Taxes

Sales Tax (Combined Rate): While the state sales tax is 6.5%, local governments add a combined rate to that. In Vancouver, the combined sales tax rate is 8.7%. This includes the state rate of 6.5%, plus additional taxes from Clark County and other local jurisdictions.

Property Taxes: Property taxes are a significant source of revenue for local governments in Washington. In Vancouver, your property tax bill is determined by the assessed value of your property and the total levy rates from various taxing districts.

Assessed Value: The value of your property is assessed by the Clark County Assessor's Office. This assessment is intended to reflect 100% of the property's fair market value.

Millage Rate: This is a combination of rates set by different taxing authorities. In Vancouver, this includes a millage rate from the state, Clark County, the City of Vancouver, local school districts, and fire districts. The total millage rate is applied per $1,000 of your property's assessed value. Washington state law generally limits the annual increase in non-voter-approved property tax revenue to 1%.

Camas, Clark County

Camas Livability Stats:

Suburban ● $$$ ● Schools: A ● Crime: B ● Community Health: Average ● Nearby Airport ● Small Town Charm

Living in Camas, Washington, is an experience defined by its small-town charm, stunning natural surroundings, and a strong, family-oriented community. Once a paper mill town, Camas has evolved into an affluent and highly desirable suburb known for its excellent public schools and a commitment to preserving green spaces. The community is tight-knit, with residents often participating in local events and taking pride in their well-maintained homes and neighborhoods. While the weather follows the typical Pacific Northwest pattern of rainy, gray winters and beautiful, dry summers, the scenic beauty of the area, including Lacamas Lake and the Columbia River Gorge, provides endless opportunities for outdoor activities like hiking and water sports. The downtown area is particularly notable for its historic and walkable design, with a variety of unique, locally-owned shops and restaurants that give the town its unique character.

Camas’s close proximity to Vancouver and Portland, Oregon, means residents have easy access to the amenities and job markets of larger cities. However, this convenience also means dealing with a higher cost of living, particularly for housing, which is significantly more expensive than both the national and state averages. The job market within Camas itself is somewhat limited, with many residents commuting to work in Vancouver or Portland, a trade-off that can negate some of the financial benefits of Washington's lack of a state income tax. Despite this, the combination of a high quality of life, a top-tier school district, and a strong sense of community makes Camas an attractive place to live for those who can afford the high price of admission.

Camas Tax Stats

Understanding the tax landscape in Camas, Washington involves looking at the state, county, and city levels, as well as the different types of taxes that apply.

State Level Taxes

Income Tax: As part of Washington, Camas has no state income tax. This applies to both personal and corporate income. It's important to note, however, that the state does have a 7% tax on certain long-term capital gains that exceed a high exemption threshold.

Sales Tax: The state of Washington has a baseline sales tax rate of 6.5%. This tax applies to most goods and services, with key exemptions for items such as groceries and prescription medicines.

Estate and Inheritance Tax: Washington has a state-level estate tax. The tax is progressive, with rates ranging from 10% to 20%. As of 2025, the tax applies to estates valued at over $2.193 million. This is a tax on the estate itself, not on the inheritance received by beneficiaries.

County and City Level Taxes

Sales Tax (Combined Rate): While the state sales tax is 6.5%, local governments add a combined rate to that. The combined sales tax rate in Camas is 8.50%. This includes the state rate of 6.5%, plus additional taxes from Clark County and other local jurisdictions.

Property Taxes: Property taxes are a significant source of revenue for local governments in Washington. In Camas, your property tax bill is determined by the assessed value of your property and the total levy rates from various taxing districts.

Assessed Value: The value of your property is assessed by the Clark County Assessor's Office. This assessment is intended to reflect 100% of the property's fair market value.

Millage Rate: This is a combination of rates set by different taxing authorities. In Camas, this includes a millage rate from the state, Clark County, the City of Camas, local school districts, and fire districts. The total millage rate is applied per $1,000 of your property's assessed value. A recent rate for the City of Camas was $2.6335 per $1,000 of assessed value. Washington state law generally limits the annual increase in non-voter-approved property tax revenue to 1%.

We have put together a comprehensive guide for Washington that includes:

Information about State and Local Taxes;

Political Context and Competitiveness;

Community Overview of the Region and Neighborhoods;

Economic Opportunity and Cost of Living; diversified economy with growing opportunities;

Schools and Education;

Civic Engagement Opportunities, including political, community and advocacy organizations.

Complete the form below to access everything the Washington Guide has to offer.

By sharing your email address, you agree to receive marketing emails from PowerMoves.

By providing your cell phone number, you have provided us with consent to send you text messages in conjunction with the services you have requested. Message & Data Rates May Apply. Text HELP for Info. Text STOP to opt out. No purchase necessary.

Why WA-03 Represents the Future

Washington’s 3rd Congressional District embodies the kind of place where you can find some stability in a changing environment.

The tax climate is favorable.

Your vote genuinely matters in one of the nation's most competitive districts

Your voice can influence policy through accessible local government and civic engagement

Your life can flourish with affordable living, economic opportunity, and community connection

Your presence helps build the inclusive, competitive democracy we all need

This isn't just a place to find refuge—it's a place to build the future.