We’ve identified communities where you will be safe and welcome, in States with low Income Taxes and where your vote will be a game-changer at the ballot box.Texas: The Lonestar State

Texas: Congressional District 28

Living in Texas' 28th Congressional District is a study in contrasts, offering a blend of urban, suburban, and rural lifestyles. The district, which stretches from the outskirts of San Antonio to the U.S.–Mexico border, is vast and diverse. This means the experience of living here can vary dramatically based on location, from the bustling city life near San Antonio to the quiet, border-town atmosphere of Laredo and the vast, open spaces of the rural counties in between.

The district is anchored by its two largest cities, Laredo and a portion of San Antonio. The lifestyle in Laredo, the nation's largest inland port, is deeply influenced by its position as a major border crossing, with a strong emphasis on trade and a vibrant blend of Mexican and American cultures. The communities around San Antonio, like Universal City and Converse, are more suburban, with family-oriented neighborhoods, well-regarded schools, and a quicker commute to urban amenities. As you travel south and west through the district, you encounter more rural counties like Atascosa, McMullen, and Starr, where the economy is more tied to ranching and agriculture. The pace of life here is slower and more laid-back, with a focus on close-knit, small-town communities.

Texas has no state income tax, but it relies on a 6.25% state sales tax (up to 8.25% with local additions) and relatively high property taxes (around 1.47% statewide) to fund public services. Texas is very tax-friendly for retirees, as it does not tax any retirement income.

Texas does not have a state estate tax or an inheritance tax.

COMMUNITY SNAPSHOTS

Laredo, Webb County

Laredo Livability Stats:

Urban/Suburban ● $ ● Schools: A ● Crime: C ● Community Health: Average ● Nearby Airport

Laredo Homes for Sale and Rent

Laredo offers a lifestyle defined by its unique position as a major U.S.-Mexico border city. It's a place where two cultures seamlessly blend, creating a vibrant atmosphere with a strong emphasis on family and community. The city has a dense suburban feel, and many residents are homeowners, enjoying a relatively affordable cost of living compared to other major Texas cities. The community is predominantly Hispanic, which is reflected in the local cuisine, language (a mix of Spanish and English, or "Spanglish," is common), and traditions.

The economy of Laredo is heavily driven by its role as the nation's largest inland port. This means that international trade and logistics are the main industries, providing a significant number of jobs. For residents, this translates to a city that is always active and a key player in cross-border commerce. Beyond the economic hubbub, Laredo has a relaxed, more laid-back pace than larger metropolitan areas. While it may not have the wide range of entertainment options found in cities like Austin or Dallas, it compensates with a strong sense of local pride and a variety of parks, recreational areas, and annual festivals that bring the community together, such as the famous Washington's Birthday Celebration.

Laredo Tax Stats

Understanding the tax landscape in Laredo, Texas, involves looking at the state, county, and local levels. Laredo is a city in Webb County.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): Laredo is located in Webb County. The city and county add a local sales tax, bringing the combined sales tax rate for Laredo to 8.25%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

Webb County: 0.50%

City of Laredo: 1.25%

Special Purpose Districts (e.g., mass transit, sports venue): 0.25%

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Laredo, your property tax bill is a combination of taxes from different entities, including:

Webb County: The county sets a millage rate for its services. For 2025, the voter-approval tax rate is $0.392498 per $100 of assessed value.

City of Laredo: The city sets its own property tax rate. The 2025 rate is $0.507623 per $100 of assessed value.

School Districts: The local school district (Laredo Independent School District or United Independent School District, depending on location) sets a millage rate for public schools.

Special Purpose Districts: Additional taxes may be levied by other local entities, such as hospital districts.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

Cibolo, Guadalupe County

Cibolo Livability Stats:

Rural ● $$ ● Schools: A ● Crime: B ● Community Health: Average

Cibolo Homes for Sale and Rent

Cibolo offers a classic suburban lifestyle that has been growing rapidly, attracting families, professionals, and retirees alike. Located northeast of San Antonio, it's a place that successfully blends a small-town, country feel with the benefits of a modern, well-developed community. While it's no longer the small farming town it once was, it has managed to maintain a strong sense of community and a family-friendly atmosphere.

The lifestyle in Cibolo is defined by convenience and quality of life. The city boasts a low crime rate and is known for its highly-rated public schools, which are a major draw for families. The housing market is a significant part of the community, with a variety of housing options from new developments to established homes, often at a more affordable price point than in nearby San Antonio. Commuting is a routine part of life for many, with easy access to major highways like I-35 and I-10, making a trip to San Antonio for work or entertainment straightforward. Local amenities are expanding, with a growing number of parks, restaurants, and shops, all contributing to a comfortable and active living environment.

Cibolo Tax Stats

Understanding the tax landscape in Cibolo, Texas, involves looking at the state, county, and local levels. Cibolo is a city that is primarily located in Guadalupe County.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): Cibolo is located in Guadalupe County. The city and county add a local sales tax, bringing the combined sales tax rate for Cibolo to 8.25%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

Guadalupe County: 0.50%

City of Cibolo: 1.50% (This is broken down into a 1.00% city tax and a 0.50% Special Purpose District tax for things like economic development and streets/drainage).

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Cibolo, your property tax bill is a combination of taxes from different entities, including:

Guadalupe County: The county sets a millage rate for its services.

City of Cibolo: The city sets its own property tax rate for maintenance, operations, and debt service.

School Districts: The local school district (primarily Schertz-Cibolo-Universal City ISD) sets a millage rate for public schools.

Special Purpose Districts: Depending on your specific location within the city, you may be subject to additional taxes for things like lateral roads.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

Rio Bravo, Webb County

Rio Bravo Livability Stats:

Suburban/Rural ● $ ● Schools: B ● Crime: a ● Community Health: Average

Rio Bravo Homes for Sale and Rent

Rio Bravo, Texas, offers a unique lifestyle that is a blend of a small, tight-knit community and a more expansive suburban feel. Located just outside of Laredo, it benefits from a more peaceful, residential atmosphere while maintaining easy access to the city's amenities and employment opportunities. The town's proximity to the Rio Grande gives it a scenic backdrop and a connection to the rich cultural heritage of the U.S.-Mexico border region.

The lifestyle in Rio Bravo is characterized by its affordability and a strong sense of community. The cost of living is significantly lower than the national average, especially for housing, which makes it an attractive option for families looking to own a home. The community is predominantly Hispanic, and this heritage is a central part of everyday life, influencing everything from local events to the friendly, neighborly atmosphere. While it may not have a wide range of its own shops or restaurants, residents can easily drive to Laredo for a greater selection of dining, retail, and entertainment. The town's small size means that people often know their neighbors, contributing to a feeling of safety and belonging.

Rio Bravo Tax Stats

Understanding the tax landscape in Rio Bravo, Texas, involves looking at the state, county, and local levels. Rio Bravo is a city in Webb County.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): Rio Bravo is located in Webb County. The city and county add a local sales tax, bringing the combined sales tax rate for Rio Bravo to 7.75%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

Webb County: 0.50%

City of Rio Bravo: 1.00%

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Rio Bravo, your property tax bill is a combination of taxes from different entities, including:

Webb County: The county sets a millage rate for its services.

City of Rio Bravo: The city sets its own property tax rate. The 2025 rate is $0.4999 per $100 of assessed value.

School Districts: The local school district (likely United Independent School District, as it serves the area) sets a millage rate for public schools.

Other Taxing Units: Additional taxes may be levied by other local entities, such as a drainage district.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

Schertz, Bexar County

Schertz Livability Stats:

Suburban/Rural ● $$ ● Schools: A ● Crime: B ● Community Health: Average

Schertz Homes for Sale and Rent

Schertz offers a lifestyle that beautifully blends small-town charm with the convenience of a larger metropolitan area. Located just northeast of San Antonio, it's a rapidly growing community known for being family-friendly and welcoming. The city has successfully maintained a close-knit atmosphere while developing into a modern suburb with a variety of housing options, from established single-family homes to new master-planned communities. Its strategic location provides easy access to the amenities and job opportunities of both San Antonio and Austin, making it a popular choice for commuters.

The quality of life in Schertz is a major draw. The city is celebrated for its excellent schools, low crime rate, and abundant recreational facilities, including numerous parks, trails, and a well-regarded aquatics center. There's a strong emphasis on community engagement, with local events like the annual 4th of July Jubilee bringing residents together. The city is also very military-friendly due to its proximity to Randolph Air Force Base, which contributes to a diverse population and a welcoming environment for military families. Overall, living in Schertz is about enjoying a comfortable, active, and affordable suburban life while staying connected to the best of what Central Texas has to offer.

Schertz Township Tax Stats

Understanding the tax landscape in Schertz, Texas, involves looking at the state, county, and local levels. Schertz is a city that spans three counties: Guadalupe, Comal, and Bexar. The specific tax rates, especially for property taxes, can vary based on which county you reside in.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): The combined sales tax rate for Schertz is 8.25%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

County: 0.50% (This is the rate for Guadalupe and Comal counties. For Bexar County, the rate is 0.00% making the combined rate 7.75%)

City of Schertz: 1.50% (This is broken down into a 1.00% city tax and a 0.50% Special Purpose District tax for things like economic development).

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Schertz, your total property tax bill is a combination of taxes from different entities. The rates will vary depending on the county and school district your property is in. Here's a breakdown of the entities that may apply:

County: The county sets a millage rate for its services. This will be either Guadalupe County, Comal County, or Bexar County.

City of Schertz: The city sets its own property tax rate for maintenance and operations.

School Districts: The local school district sets a millage rate for public schools. The most common school district for Schertz residents is the Schertz-Cibolo-Universal City Independent School District (ISD), but some areas may fall under Comal ISD or East Central ISD.

Special Purpose Districts: Additional taxes may be levied by other local entities, such as lateral road districts or other special taxing units.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

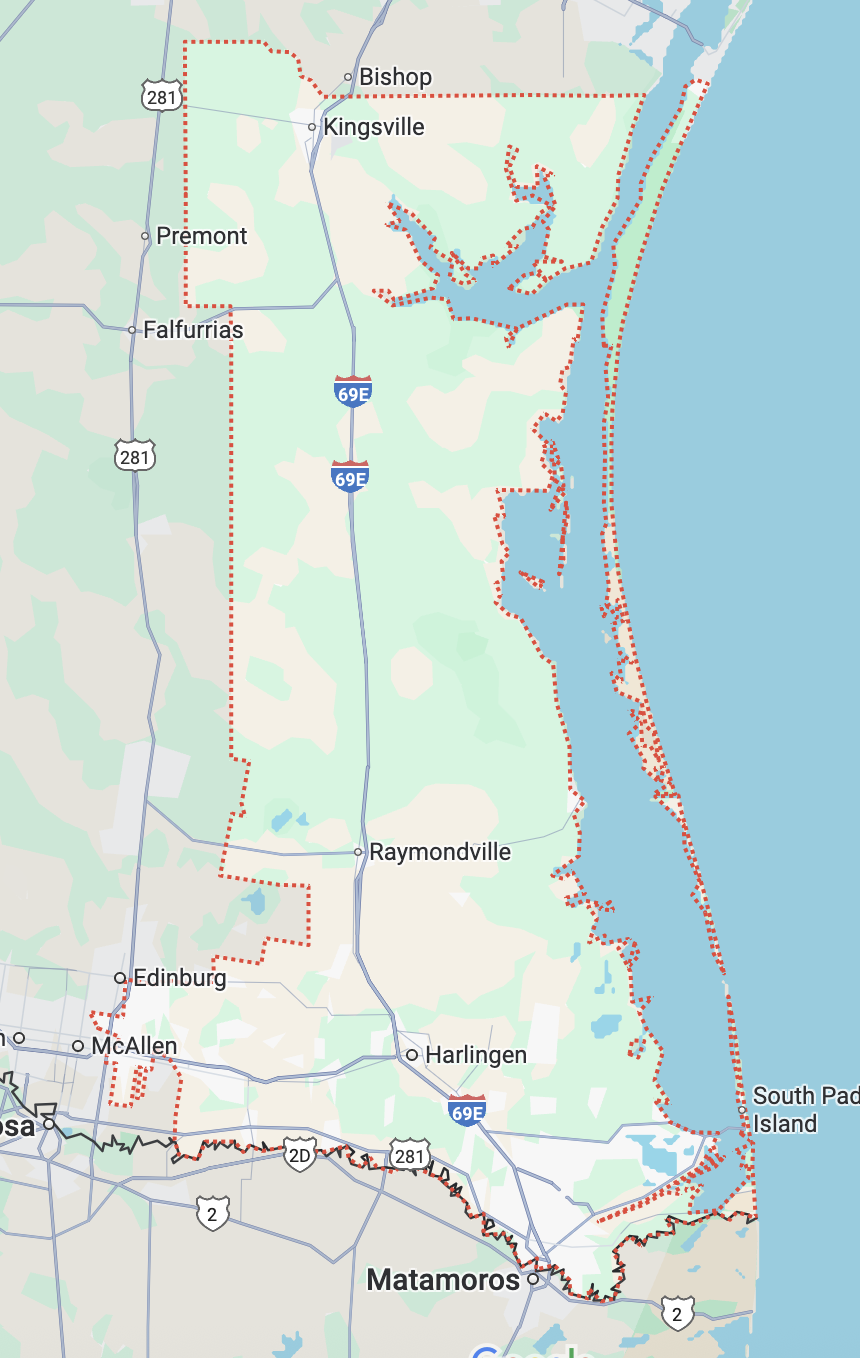

Texas: Congressional District 34

Living in Texas' 34th Congressional District offers a diverse lifestyle that spans from urban centers to rural landscapes, with a strong emphasis on a rich cultural heritage. The district is located in the southernmost part of the state, encompassing a portion of the Rio Grande Valley and extending north to the Gulf Coast. The experience of living here is largely shaped by its proximity to the U.S.-Mexico border, which gives the region a vibrant, bicultural feel.

The district's population is over 90% Hispanic, which is reflected in the community's cuisine, language, and traditions. The lifestyle is a mix of urban and rural. Major cities like Brownsville and Harlingen offer more developed commercial and residential areas, with a focus on trade and logistics due to their proximity to Mexico. In these areas, you'll find a wide range of restaurants and a strong sense of community pride. The rural parts of the district, which include counties like Willacy and Kenedy, are characterized by a more agricultural and laid-back pace of life. The economy in these areas is often tied to farming, ranching, and fishing.

The economy of the 34th district is heavily influenced by international trade, healthcare, and education. The median household income is lower than the national average, and the median property value is significantly more affordable, making homeownership more accessible. The community's cultural richness is a defining feature, with local festivals and events celebrating its bicultural heritage. The lifestyle is generally family-oriented, with a strong focus on community bonds and a resilient, hardworking spirit.

Texas has no state income tax, but it relies on a 6.25% state sales tax (up to 8.25% with local additions) and relatively high property taxes (around 1.47% statewide) to fund public services. Texas is very tax-friendly for retirees, as it does not tax any retirement income.

Texas does not have a state estate tax or an inheritance tax.

COMMUNITY SNAPSHOTS

Rancho Viejo, Cameron County

Rancho Viejo Livability Stats:

Suburban ● $$ ● Schools: B ● Crime: B ● Community Health: Average

Rancho Viejo Homes for Sale and Rent

Rancho Viejo offers a lifestyle that is best described as a tranquil, resort-style community with a strong sense of place. Located near Brownsville and Harlingen in the Rio Grande Valley, it provides a serene escape from the more bustling urban areas while still being close to essential amenities. The town is primarily a residential community, with a significant number of retirees and professionals drawn to its peaceful atmosphere and high quality of life.

The defining feature of Rancho Viejo is its beautiful natural setting. The community is built around scenic tropical waterways, known as resacas, and a premier golf course, which provides a picturesque backdrop for daily life. Outdoor activities, particularly golfing, are central to the lifestyle here. Many homes are situated on large lots with stunning views, and the community is designed with an emphasis on preserving open spaces and natural beauty. While it is a smaller town, residents appreciate its safety, well-maintained streets, and a friendly, tight-knit feel where neighbors often know one another. The town's proximity to larger cities means that a wider selection of dining, shopping, and healthcare options are just a short drive away.

Rancho Viejo Tax Stats

Understanding the tax landscape in Rancho Viejo, Texas, involves looking at the state, county, and local levels. Rancho Viejo is a town in Cameron County.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): Rancho Viejo is located in Cameron County. The combined sales tax rate for the town is 7.25%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

Town of Rancho Viejo: 1.00%

There is no county or special tax in Rancho Viejo.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Rancho Viejo, your property tax bill is a combination of taxes from different entities, including:

Cameron County: The county sets a millage rate for its services.

Town of Rancho Viejo: The town sets its own property tax rate for maintenance, operations, and debt service.

School Districts: The local school district (likely Los Fresnos CISD, as it serves the area) sets a millage rate for public schools.

Special Purpose Districts: Additional taxes may be levied by other local entities, such as a drainage district or other special taxing units.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

Palm Valley, Cameron County

Palm Valley Livability Stats:

Suburban/Rural ● $$ ● Schools: B ● Crime: A ● Community Health: Average

Palm Valley Homes for Sale and Rent

Palm Valley offers a tranquil, small-town lifestyle that is a blend of quiet residential living and recreational amenities. Located in the Rio Grande Valley, it serves as a suburban retreat from the larger cities of Harlingen and Brownsville. The community is known for its beautiful, well-maintained homes and a peaceful atmosphere that is particularly attractive to retirees, though it also draws families and professionals.

The lifestyle in Palm Valley is centered around a premier golf course and scenic resacas (meandering waterways), which provide a picturesque backdrop and opportunities for outdoor activities. This is a place where people value a slower, more laid-back pace of life. The crime rate is significantly lower than the Texas average, and the public schools are highly rated. While the town itself is small, residents enjoy the convenience of being just a short drive from a wider range of shopping, dining, and entertainment options in nearby Harlingen. The community has a strong sense of pride and identity, offering a peaceful and safe environment for those who call it home.

Palm Valley Tax Stats

Understanding the tax landscape in Palm Valley, Texas, involves looking at the state, county, and local levels. Palm Valley is a town in Cameron County.

State Level Taxes:

Income Tax: Texas is one of a handful of states with no state income tax. This applies to individuals and corporations, and it also means there is no state tax on retirement income, pensions, or social security benefits. This is a significant draw for both residents and businesses.

Sales Tax: The state of Texas has a baseline sales tax rate of 6.25%. This applies to the sale of most tangible personal property, with key exemptions like groceries and prescription medicines.

Estate and Inheritance Tax: Texas does not have a state-level estate tax or an inheritance tax. This is beneficial for beneficiaries, who won't have to pay a state tax on the assets they inherit. However, large estates may still be subject to the federal estate tax.

County and Local Level Taxes:

Sales Tax (Combined Rate): Palm Valley is located in Cameron County. The combined sales tax rate for the town is 8.25%. This is the rate you'll pay on taxable purchases within the city. This combined rate includes:

State of Texas: 6.25%

Town of Palm Valley: 2.00%

There is no county or special purpose district sales tax in Palm Valley.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Palm Valley, your property tax bill is a combination of taxes from different entities, including:

Cameron County: The county sets a millage rate for its services.

Town of Palm Valley: The town sets its own property tax rate for maintenance, operations, and debt service. The 2023 rate was $0.515463 per $100 of assessed value.

School Districts: The local school district sets a millage rate for public schools. Palm Valley is served by the Harlingen Independent School District (ISD). Some residents may also pay a tax to the South Texas ISD.

Special Purpose Districts: Additional taxes may be levied by other local entities, such as a drainage district.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. In Texas, the assessed value is a percentage of the property's market value, and the state has some tax exemptions for homesteads, which can reduce the taxable value.

We have put together a comprehensive guide for Texas that includes:

Information about State and Local Taxes;

Political Context and Competitiveness;

Community Overview of the Region and Neighborhoods;

Economic Opportunity and Cost of Living; diversified economy with growing opportunities;

Schools and Education;

Civic Engagement Opportunities, including political, community and advocacy organizations.

Complete the form below to access everything the Texas Guide has to offer.

By sharing your email address, you agree to receive marketing emails from PowerMoves.

By providing your cell phone number, you have provided us with consent to send you text messages in conjunction with the services you have requested. Message & Data Rates May Apply. Text HELP for Info. Text STOP to opt out. No purchase necessary.

Why Texas Represents the Future

Texas’s Congressional Districts embodies the kind of place where you can find some stability in a changing environment.

The tax climate is favorable.

Your vote genuinely matters in one of the nation's most competitive districts

Your voice can influence policy through accessible local government and civic engagement

Your life can flourish with affordable living, economic opportunity, and community connection

Your presence helps build the inclusive, competitive democracy we all need

This isn't just a place to find refuge—it's a place to build the future.