We’ve identified communities where you will be safe and welcome, in States with low Income Taxes and where your vote will be a game-changer at the ballot box.Pennsylvania: Virtue, Liberty and Independence

Pennsylvania: Congressional District 7

Living in Pennsylvania's 7th Congressional Districts offers a diverse experience across suburban, urban, and rural landscapes. The cost of living varies, with the 7th CD (Lehigh Valley) having a median household income of about $79,206 and median property values around $278,900. The 8th CD (Northeastern Pennsylvania, including Scranton/Wilkes-Barre) is generally more affordable, with a median income of $61,140 and property values around $220,800. The 10th CD (South Central Pennsylvania, including Harrisburg) features a median income of $78,636 and property values around $235,100.

Pennsylvania has a flat 3.07% individual income tax and a 6% state sales tax, with significant local property taxes funding public services. Notably, retirement income is generally exempt from state and local income taxes.

Pennsylvania does not have an estate tax, but it does impose an inheritance tax on the value of assets passed to beneficiaries. The inheritance tax rates vary based on the relationship between the decedent and the beneficiary.

COMMUNITY SNAPSHOTS

Breinigsville, Lehigh County

Breinigsville Livability Stats:

Rural/Suburban ● $$ ● Schools: A ● Crime: N/A ● Community Health: Average ● Nearby Airport

Breinigsville Homes for Sale and Rent

Breinigsville offers a suburban lifestyle with a quiet, small-town feel, making it an appealing choice for families and those who appreciate a slower pace. The community is known for its well-maintained neighborhoods, many of which feature spacious homes with manicured lawns. Residents often enjoy the proximity to natural spaces, with local parks and the nearby Trexler Nature Preserve providing opportunities for outdoor activities like hiking and picnicking. While Breinigsville itself is primarily residential, its strategic location in the Lehigh Valley means that a wide array of amenities, including shopping centers, restaurants, and entertainment venues, are just a short drive away in neighboring towns like Allentown and Macungie.

One of the key advantages of living in Breinigsville is its excellent connectivity. The area is situated near major highways such as I-78 and Route 22, which makes commuting to larger cities like Philadelphia and New York City relatively straightforward. This accessibility, combined with the presence of several large warehouses and distribution centers (many of which are major employers), contributes to a robust local economy. Despite its growth and development, Breinigsville has managed to retain a strong sense of community. Local events, farmers' markets, and school activities are common, fostering a friendly and welcoming atmosphere where neighbors often know each other by name.

Breingisville Tax Stats

Understanding the tax landscape in Breinigsville, Pennsylvania, involves looking at the state, county, and local levels. Breinigsville is an unincorporated community within Upper Macungie Township in Lehigh County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania has a state-level inheritance tax that is a significant part of its tax structure. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Breinigsville are subject to a local Earned Income Tax (EIT). The combined rate for Upper Macungie Township and the East Penn School District is 1.15%. This tax is typically withheld from an employee's paycheck by their employer.

Sales Tax (Combined Rate): Unlike other states, Pennsylvania does not have a county or local-level sales tax in Lehigh County. Therefore, the combined sales tax rate for Breinigsville remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Breinigsville, your total property tax bill is a combination of taxes from three different entities:

Lehigh County: Sets a millage rate for county services.

Upper Macungie Township: Sets a millage rate for township services.

East Penn School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Lower Nazareth, Northampton County

Lower Nazareth Livability Stats:

Rural ● $$ ● Schools: A ● Crime: N/A ● Community Health: Average

Lower Nazareth Homes for Sale and Rent

Lower Nazareth offers a lifestyle that beautifully blends rural charm with suburban convenience, making it a desirable location in the Lehigh Valley. The community is characterized by its tranquil, scenic landscape, with a feeling of spaciousness due to its large residential lots and surrounding farmland. While it provides a quiet, peaceful atmosphere, residents are never far from the necessities and attractions of modern life. The township has seen some development, particularly with the growth of retail and distribution centers, but it maintains a family-friendly vibe and a strong sense of community. Its location near major roadways like Routes 22 and 33 makes commuting to nearby cities like Bethlehem and Easton, and even farther destinations like New York City, relatively easy.

One of the most significant draws of Lower Nazareth is its reputation for excellent public schools, which are part of the highly-rated Nazareth Area School District. This, along with its low crime rates, makes it a popular choice for families looking for a safe and nurturing environment to raise children. The area provides a good mix of local amenities, with shopping centers, restaurants, and parks available for residents. While the immediate area may not have a bustling downtown, the historic and vibrant Main Street of Nazareth borough is just a short drive away, offering additional dining, shopping, and community events. Overall, living in Lower Nazareth is about enjoying a quiet, high-quality suburban life with easy access to the broader offerings of the Lehigh Valley.

Lower Nazareth Tax Stats

Understanding the tax landscape in Lower Nazareth, Pennsylvania, involves looking at the state, county, and local levels. Lower Nazareth is a township within Northampton County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Lower Nazareth are subject to a local Earned Income Tax (EIT). The combined rate for Lower Nazareth Township and the Nazareth Area School District is 1.45%. This is a combination of 0.50% for the township, 0.25% for open space preservation, and 0.70% for the school district. This tax is typically withheld from an employee's paycheck by their employer.

Sales Tax (Combined Rate): Northampton County does not add a local sales tax. Therefore, the combined sales tax rate for Lower Nazareth remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Lower Nazareth, your total property tax bill is a combination of taxes from three different entities:

Northampton County: Sets a millage rate for county services. The 2025 rate is 10.8 mills.

Lower Nazareth Township: Sets a millage rate for township services. The 2025 rate is 5.50 mills.

Nazareth Area School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Saucon Valley, Northampton County

Saucon Livability Stats:

Suburban/Rural ● $$ ● Schools: A ● Crime: B ● Community Health: Average ● Nearby Airport

Saucon Homes for Sale and Rent

Saucon Valley offers a highly sought-after lifestyle that combines the tranquility of a scenic, suburban area with the convenience of being close to urban amenities. The region, which includes parts of Hellertown and Center Valley, is known for its picturesque landscape of rolling hills and lush greenery, providing a beautiful backdrop for a variety of outdoor activities. Residents enjoy a peaceful environment that feels far removed from the hustle and bustle, yet they are just a short drive from the cultural, dining, and shopping hubs of Bethlehem and Allentown. This blend of peaceful living and easy access to city life is a defining characteristic of the community.

The community atmosphere in Saucon Valley is a point of pride for its residents. There is a strong sense of togetherness, with a variety of local events, farmers' markets, and community-based activities that foster connections and a friendly, welcoming spirit. Education is highly valued, with the prestigious Saucon Valley School District serving as a major draw for families. The area also boasts a diverse range of amenities, including the upscale Promenade Shops at Saucon Valley, an outdoor lifestyle center with high-end retailers, restaurants, and a movie theater. For those who enjoy an active lifestyle, there are numerous golf courses, parks, and walking trails, while the proximity to major highways like I-78 and Route 309 makes commuting and travel to places like Philadelphia and New York City easily manageable.

Saucon Tax Stats

Understanding the tax landscape in Saucon Valley, Pennsylvania, involves looking at the state, county, and local levels. Saucon Valley is a region encompassing several municipalities, most notably parts of Upper Saucon Township in Lehigh County and Lower Saucon Township in Northampton County, as well as the borough of Hellertown. The tax rates can vary slightly depending on the specific municipality.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Saucon Valley are subject to a local Earned Income Tax (EIT). The specific combined rate for a resident depends on their municipality and school district. For example, residents of Lower Saucon Township and the Saucon Valley School District pay a combined rate of 1.00%. This tax is typically withheld from an employee's paycheck by their employer.

Sales Tax (Combined Rate): Neither Lehigh County nor Northampton County adds a local sales tax. Therefore, the combined sales tax rate for Saucon Valley remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Saucon Valley, your total property tax bill is a combination of taxes from three different entities:

County: This is either Lehigh County or Northampton County, depending on your address. Each county sets its own millage rate.

Municipality: Your township (e.g., Upper Saucon or Lower Saucon) or borough (e.g., Hellertown) sets a millage rate for local services.

School District: The Saucon Valley School District sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Forks Township, Northampton County

Forks Township Livability Stats:

Suburban/Rural ● $$ ● Schools: B ● Crime: A ● Community Health: Average

Forks Township Homes for Sale and Rent

Forks Township, located just north of Easton, offers a desirable blend of suburban and rural living. The landscape is characterized by rolling hills and open spaces, providing residents with a sense of tranquility and a connection to nature. This peaceful environment is a significant draw, especially for families and those looking for a quiet escape from the more densely populated areas of the Lehigh Valley. Despite its serene setting, Forks Township is far from isolated, with its strategic location providing easy access to the amenities and employment opportunities of nearby cities.

The community in Forks Township is known for its strong, family-friendly atmosphere. Residents often describe the area as close-knit, with a welcoming feel that is attractive to new residents. The highly-regarded public schools are a major reason for the township's popularity among families. While the area has seen growth with new residential developments and some commercial expansion, it has managed to maintain a high quality of life. Access to major highways like Routes 33 and 22 makes it a convenient location for commuters, connecting them to Bethlehem, Allentown, and even New Jersey. For recreation, residents can enjoy local parks and green spaces, while the proximity to Easton's vibrant downtown offers a wide range of dining, shopping, and entertainment options.

Forks Township Tax Stats

Understanding the tax landscape in Forks Township, Pennsylvania, involves looking at the state, county, and local levels. Forks Township is located in Northampton County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania has a state-level inheritance tax that is a significant part of its tax structure. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax (EIT): Forks Township residents are subject to a local Earned Income Tax. The total EIT rate for Forks Township and the Easton Area School District is 1.00% (0.50% for the township and 0.50% for the school district). This tax is typically withheld from an employee's paycheck.

Local Services Tax (LST): Forks Township also levies a Local Services Tax of $52 per year on people who work in the township. There is an exemption for individuals with a total income from all sources under $12,000 for the calendar year.

Sales Tax (Combined Rate): Northampton County does not add a local sales tax. Therefore, the combined sales tax rate for Forks Township remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Forks Township, your total property tax bill is a combination of taxes from three different entities:

Northampton County: Sets a millage rate for county services. The current millage rate is 10.8 mills.

Forks Township: Sets a millage rate for township services. The current millage rate is 7.5 mills.

Easton Area School District: Sets a millage rate that funds local public schools. The current millage rate is 66.68 mills.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

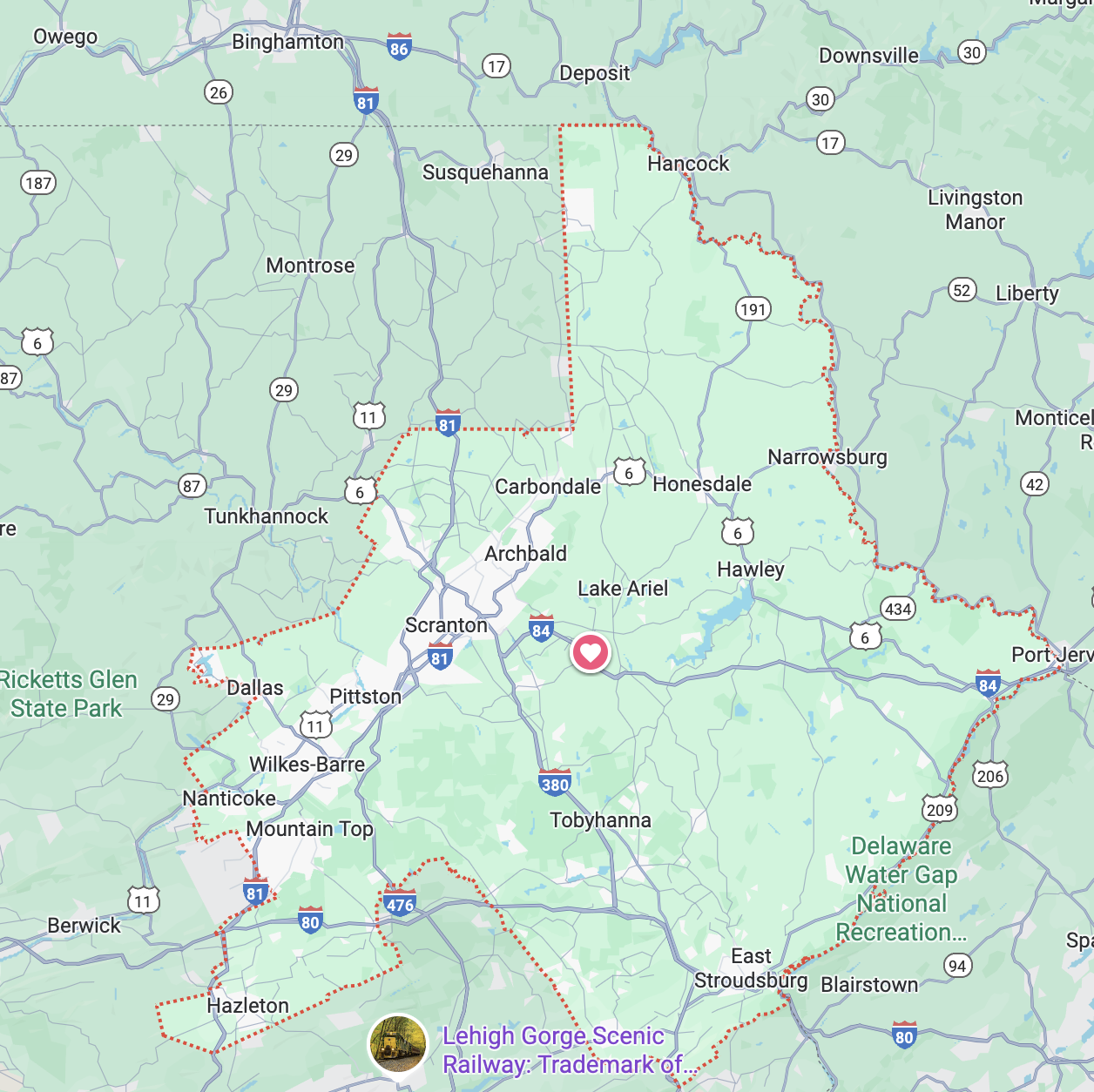

Pennsylvania: Congressional District 8

Living in Pennsylvania's 8th Congressional District is a study in contrasts, offering a mix of lifestyles that are tied together by a common sense of place in the state's northeastern region. The district is vast, encompassing urban centers, suburban towns, and sprawling rural areas. At its heart are the cities of Scranton and Wilkes-Barre, which have a rich history rooted in the coal and manufacturing industries. In these areas, you'll find a resilient, community-oriented spirit, with a focus on local businesses and a strong sense of neighborhood identity.

Beyond the urban hubs, the district transitions into the scenic landscapes of the Poconos and surrounding counties. This is where you find a more rural or suburban lifestyle, with access to nature and a slower pace of life. The region is a haven for outdoor enthusiasts, offering opportunities for hiking, fishing, and enjoying the changing seasons. Residents in these areas often appreciate the space and tranquility, while still being within a reasonable drive of the amenities and job opportunities of larger towns. The overall feeling of the district is one of hardworking people who value their heritage and a connection to the land, whether they live in a row home in Scranton or a secluded house in the mountains.

Pennsylvania has a flat 3.07% individual income tax and a 6% state sales tax, with significant local property taxes funding public services. Notably, retirement income is generally exempt from state and local income taxes.

Pennsylvania does not have an estate tax, but it does impose an inheritance tax on the value of assets passed to beneficiaries. The inheritance tax rates vary based on the relationship between the decedent and the beneficiary.

COMMUNITY SNAPSHOTS

Stroudsburg, Monroe County

Stroudsburg Livability Stats:

Suburban ● $$$ ● Schools: B ● Crime: N/A ● Community Health: Average ● Airport: 30 - 60 Minutes ● Charming Town ● Walkable

Stroudsburg Homes for Sale and Rent

Stroudsburg offers a unique and vibrant lifestyle that blends the charm of a historic small town with the natural beauty of the Pocono Mountains. The borough itself has a walkable, bustling downtown area filled with a variety of locally owned shops, art galleries, and diverse restaurants. Residents can often be found strolling down Main Street, enjoying a coffee, or catching a show at the historic Sherman Theater, which is a centerpiece of the local arts scene. The community takes pride in its history, and the 19th-century architecture gives the town a distinctive, picturesque character. This active downtown core provides a lively social hub that is a defining feature of Stroudsburg living.

Beyond the borough's center, Stroudsburg serves as a gateway to the broader Pocono Mountains region. This means that a life here is intimately connected to outdoor recreation. From hiking and biking on the Levee Loop Trail along the Brodhead Creek to fishing and enjoying nature in the nearby Delaware Water Gap National Recreation Area, there is no shortage of ways to get outside. The change of seasons is particularly celebrated, with festivals and activities centered around everything from the vibrant fall foliage to winter sports like skiing and snow tubing. This combination of a quaint, cultured town and easy access to a vast natural playground makes Stroudsburg an appealing place for those who want a community with both small-town heart and adventurous spirit.

Stroudsburg Tax Stats

Understanding the tax landscape in Stroudsburg, Pennsylvania, involves looking at the state, county, and local levels. Stroudsburg is a borough in Monroe County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Stroudsburg are subject to a local Earned Income Tax (EIT). The combined rate for Stroudsburg Borough and the Stroudsburg Area School District is 1.00%. This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Stroudsburg Borough also levies a Local Services Tax. This tax is typically $52 per year on people who work in the borough, with an exemption for individuals with an earned income of less than $12,000.

Sales Tax (Combined Rate): Monroe County does not add a local sales tax. Therefore, the combined sales tax rate for Stroudsburg remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Stroudsburg, your total property tax bill is a combination of taxes from three different entities:

Monroe County: Sets a millage rate for county services.

Stroudsburg Borough: Sets a millage rate for borough services.

Stroudsburg Area School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Pocono Township, Monroe County

Pocono Township Livability Stats:

Rural ● $$ ● Schools: B ● Crime: B ● Community Health: Average ● Airport: 30 - 60 Minutes ● Outdoor Adventure

Pocono Township Homes for Sale and Rent

Pocono Township offers a balanced lifestyle, serving as a hub for both residents and tourists in the heart of the Poconos. Unlike some of the more secluded communities, the township has a more developed commercial presence, especially along the Route 611 corridor. This means residents have easy access to a variety of retail stores, restaurants, and essential services without having to travel far. The township is home to major attractions like the Great Wolf Lodge and is in close proximity to popular ski resorts and the Pocono Raceway, which draws a diverse crowd and contributes to a dynamic local economy.

Despite the commercial activity, Pocono Township maintains a strong sense of community and a family-friendly atmosphere. Many residential areas are set against the scenic backdrop of the mountains, providing a peaceful environment. The township is well-equipped with public parks and recreational facilities, including sports fields, playgrounds, and walking trails. It also places a high value on education, being part of a reputable school district. The lifestyle is a mix of convenience and natural beauty, allowing residents to enjoy both the modern amenities of suburban life and the outdoor adventures that the Pocono Mountains are famous for.

Pocono Township Tax Stats

Understanding the tax landscape in West Des Moines, Iowa, involves looking at the state, county, and city levels, as well as the different types of taxes that apply.

State Level Taxes:

Income Tax: Iowa has been gradually phasing in a flat income tax rate, which officially went into effect at a flat rate of 3.8% on January 1, 2025. This change replaces the previous progressive tax system that had multiple tax brackets. For taxpayers aged 55 and older, all retirement income, including pensions, annuities, and distributions from 401(k)s and IRAs, is also exempt from state income tax.

Sales Tax: The state of Iowa has a baseline sales tax rate of 6.0%. This applies to most goods and services, with exemptions for items like most groceries and prescription medications.

Estate and Inheritance Tax: Iowa has historically had an inheritance tax, but it has been officially repealed for deaths occurring on or after January 1, 2025. This means that beneficiaries no longer have to pay a state tax on the assets they inherit from an Iowa resident. Similar to Florida, large estates may still be subject to the federal estate tax.

County and City Level Taxes:

Sales Tax (Combined Rate): While Iowa has a 6.0% state sales tax, many local jurisdictions add a local option sales tax. For West Des Moines, there is an additional 1.0% local option sales tax, bringing the combined sales tax rate for purchases to 7.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments in Iowa. In West Des Moines, your property tax bill is determined by two main factors: the assessed value of your property and the millage rate.

Assessed Value: The value of your property is assessed by the Polk County Assessor's Office. A unique feature of Iowa's system is the "assessment limitation," commonly referred to as the "rollback," which is applied to assessed values. The rollback percentage is a statewide adjustment that reduces a property's assessed value to a lower, taxable value to help control tax increases during periods of inflation.

Millage Rate: This is a combination of rates set by different taxing authorities. For West Des Moines residents, this includes rates from the City of West Des Moines, Polk County, and the West Des Moines Community School District. The total millage rate is the sum of these different rates. For Fiscal Year 2025, the City of West Des Moines's total millage rate was approximately $10.85 (per $1,000 of taxable valuation). The West Des Moines Community School District's total levy was approximately $12.22 (per $1,000 of taxable valuation).

Pocono Pines, Monroe County

Pocono Pines Livability Stats:

Suburban/Rural ● $$ ● Schools: B ● Crime: N/A ● Community Health: Average ● Airport: 30 - 60 Minutes ● Nearby Skiing

Pocono Pines Homes for Sale and Rent

Pocono Pines offers a quintessential Poconos experience, defined by a lifestyle deeply connected to nature and centered around community-oriented, recreational living. The area is known for being a resort community that has increasingly become a year-round home for many, especially retirees and families seeking a quieter pace. The most prominent features are the private lake communities, such as Lake Naomi and Pinecrest Lake, which serve as the social and recreational hubs of the area. These communities offer a wealth of amenities, including boating, fishing, swimming, golf, and tennis, fostering a tight-knit and active atmosphere.

The lifestyle in Pocono Pines is all about embracing the outdoors, no matter the season. In the warmer months, residents enjoy the lakes for water sports and relaxation on the sandy beaches. The area is also surrounded by lush forests and rolling terrain, providing endless opportunities for hiking, biking, and wildlife watching. When winter arrives, the landscape transforms into a snowy wonderland, with nearby ski resorts and opportunities for snowshoeing, cross-country skiing, and ice skating on the frozen lakes. While the town itself is small, its location is ideal for those who want a serene, secluded feel without being completely isolated. It's a short drive to the larger retail centers, restaurants, and attractions of the Poconos, ensuring that residents have the best of both worlds: a peaceful retreat and access to modern conveniences.

Pocono Pines Tax Stats

Understanding the tax landscape in Pocono Pines, Pennsylvania, involves looking at the state, county, and local levels. Pocono Pines is located in Tobyhanna Township, Monroe County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. A key feature of Pennsylvania's tax code is that it does not tax retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Pocono Pines are subject to a local Earned Income Tax (EIT). The combined rate for Tobyhanna Township and the Pocono Mountain School District is 1.00%, which is split evenly between the township and the school district. This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Tobyhanna Township also levies a Local Services Tax of $52 per year on people who work in the township. There is an exemption for individuals with a total earned income of less than $12,000 for the calendar year.

Sales Tax (Combined Rate): Monroe County does not add a local sales tax. Therefore, the combined sales tax rate for Pocono Pines remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Pocono Pines, your total property tax bill is a combination of taxes from three main entities:

Monroe County: Sets a millage rate for county services.

Tobyhanna Township: Sets a millage rate for township services, including a separate tax for police and a fire tax.

Pocono Mountain School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Smithfield Township, Monroe County

Smithfield Livability Stats:

Suburban/Rural ● $$ ● Schools: B ● Crime: N/A ● Community Health: Above Average

Smithfield Homes for Sale and Rent

Smithfield Township offers a peaceful, suburban-rural mix in the scenic Pocono Mountains. Residents enjoy a slower pace of life with plenty of open space and a strong connection to nature. This is a place where many families and young professionals have found a home, drawn by the quiet neighborhoods and the sense of community. The lifestyle is well-balanced, providing the tranquility of a more remote area while still being within easy reach of urban amenities.

The township's location is one of its biggest assets. Situated along the Delaware River, it offers abundant opportunities for outdoor activities, from swimming and kayaking at Smithfield Beach to hiking and exploring the numerous parks and natural areas. The proximity to the Delaware Water Gap National Recreation Area means that residents have an expansive natural playground right on their doorstep. For everyday needs and social outings, neighboring towns like Stroudsburg provide a wide array of dining, shopping, and entertainment options, ensuring that living in Smithfield Township doesn't mean sacrificing convenience. The area also boasts well-regarded schools, making it an attractive choice for those looking to raise a family in a safe and supportive environment.

Smithfield Tax Stats

Understanding the tax landscape in Smithfield, Pennsylvania, involves looking at the state, county, and local levels. Smithfield is a township in Monroe County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. A key feature of Pennsylvania's tax code is that it does not tax retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Smithfield Township are subject to a local Earned Income Tax (EIT). The combined rate for the township and the East Stroudsburg Area School District is 1.00%. This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Smithfield Township also levies a Local Services Tax of $52 per year on people who work in the township. There is an exemption for individuals with an earned income of less than $12,000 for the calendar year.

Sales Tax (Combined Rate): Monroe County does not add a local sales tax. Therefore, the combined sales tax rate for Smithfield remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Smithfield, your total property tax bill is a combination of taxes from four main entities:

Monroe County: Sets a millage rate for county services. The 2025 rate is 5.4773 mills.

Monroe County Library System: Sets a millage rate for library services. The 2025 rate is 0.185914 mills.

Smithfield Township: Sets millage rates for township services, including a general tax, fire tax, and EMS tax. The 2025 rates are 1.96 mills for the general tax, 0.550 mills for the fire tax, and 0.30 mills for the EMS tax.

East Stroudsburg Area School District: Sets a millage rate that funds local public schools. The 2025 rate is 31.67 mills.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Pennsylvania: Congressional District 10

Living in Pennsylvania's 10th Congressional District offers a diverse lifestyle that reflects its varied geography, which includes the state's capital and its surrounding suburban and rural areas. This district is anchored by the city of Harrisburg, with other significant areas in Cumberland and York counties. The experience of living here can vary significantly depending on whether you're in the urban center, a bustling suburban town, or the peaceful countryside.

In the more urban parts of the district, particularly Harrisburg, residents enjoy a dynamic city life with a rich history and a growing cultural scene. The city is home to the stunning Pennsylvania State Capitol and offers a wide array of restaurants, theaters, and a lively arts community. The Susquehanna River provides a beautiful backdrop for outdoor activities like walking and biking. As you move out into the suburban parts of Cumberland and York counties, the atmosphere becomes more family-oriented. These areas are known for their highly-rated public schools, safe neighborhoods, and a mix of well-maintained residential communities and commercial development. Commuting is a common part of life here, with many people driving to jobs in and around Harrisburg.

Beyond the suburbs, the district extends into more rural territory. Here, the lifestyle is defined by a connection to agriculture and open space. The landscape is characterized by rolling farmland and small, close-knit communities. Residents in these areas value the tranquility and a slower pace of life, while still having access to the amenities of larger towns just a short drive away. This blend of urban convenience, suburban comfort, and rural serenity is a defining characteristic of the 10th Congressional District, with a resilient population that values hard work and community.

Pennsylvania has a flat 3.07% individual income tax and a 6% state sales tax, with significant local property taxes funding public services. Notably, retirement income is generally exempt from state and local income taxes.

Pennsylvania does not have an estate tax, but it does impose an inheritance tax on the value of assets passed to beneficiaries. The inheritance tax rates vary based on the relationship between the decedent and the beneficiary.

COMMUNITY SNAPSHOTS

Lower Paxton Township, Dauphin County

Lower Paxton Township Livability Stats:

Suburban ● $$$ ● Schools: B ● Crime: B ● Community Health: Average ● Nearby Airport

Lower Paxton Township Homes for Sale and Rent

Lower Paxton Township, situated just east of Harrisburg, offers a desirable blend of suburban living with the advantages of being near the state capital. It's a large and well-developed township with a mix of residential neighborhoods, commercial centers, and plenty of green space. This combination provides a comfortable, convenient lifestyle that's a major draw for families and professionals. The majority of residents own their homes, and the neighborhoods are known for being well-maintained and peaceful.

A defining feature of Lower Paxton is its strong focus on community and quality of life. The township has an extensive parks and recreation system, with numerous parks, playgrounds, and sports facilities that are well-used for organized leagues and events. These amenities contribute to a vibrant, active community spirit. While it has its own commercial districts, including a variety of restaurants and retail stores, its location offers easy access to the broader amenities of the Harrisburg metropolitan area. Commuting to downtown Harrisburg for work or to nearby Hershey for entertainment is a straightforward part of life for many residents. The public school system in the township is highly regarded, making it a popular choice for those with school-aged children.

Lower Paxton Tonwship Tax Stats

Understanding the tax landscape in Lower Paxton Township, Pennsylvania, involves looking at the state, county, and local levels. Lower Paxton is a township in Dauphin County, located near Harrisburg.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania has a state-level inheritance tax that is a significant part of its tax structure. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Lower Paxton Township are subject to a local Earned Income Tax (EIT). The combined rate for the township and the Central Dauphin School District is 2.0%. This tax is split between the school district (1.5%) and the township (0.5%). This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Lower Paxton Township also levies a Local Services Tax of $52 per year on people who work in the township. There is an exemption for individuals with a total income from all sources under $12,000 for the calendar year.

Sales Tax (Combined Rate): Dauphin County does not add a local sales tax. Therefore, the combined sales tax rate for Lower Paxton Township remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Lower Paxton, your total property tax bill is a combination of taxes from three different entities:

Dauphin County: Sets a millage rate for county services, as well as a separate rate for the county library system. The 2025 rates are 8.376 mills for general purposes and 0.35 mills for the library.

Lower Paxton Township: Sets a millage rate for township services, including a general tax, fire protection, and library funding.

Central Dauphin School District: Sets a millage rate that funds local public schools. The 2025 rate is 17.4639 mills.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Camp Hill, Cumberland County

Camp Hill Livability Stats:

Suburban ● $$ ● Schools: A ● Crime: B ● Community Health: Average ● Nearby Airport ● Walkable

Camp Hill Homes for Sale and Rent

Camp Hill offers a classic and highly sought-after suburban lifestyle, distinguished by its historic charm, walkability, and strong sense of community. Located on the "West Shore" of the Susquehanna River, just across from Harrisburg, the borough provides a peaceful residential environment with the convenience of being minutes away from the state capital's employment, dining, and cultural attractions. The tree-lined streets and well-maintained homes, many of which are historic Craftsman or Colonial styles, give the area a timeless and picturesque feel.

The heart of Camp Hill life revolves around its vibrant and walkable downtown along Market Street. This area is a hub of activity, featuring a variety of local shops, cafes, and restaurants that foster a strong sense of neighborhood identity. Residents enjoy easy access to amenities, including parks, a public swimming pool, and the renowned Fredricksen Library. For families, the public school district is a major draw, known for its high ratings and active parent involvement. This blend of a welcoming community, a charming downtown, and a convenient location makes Camp Hill an appealing place to live for those who value both a traditional small-town feel and modern accessibility.

Camp Hill Township Tax Stats

Understanding the tax landscape in Camp Hill, Pennsylvania, involves looking at the state, county, and local levels. Camp Hill is a borough in Cumberland County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. A key feature of Pennsylvania's tax code is that it does not tax retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Camp Hill Borough are subject to a local Earned Income Tax (EIT). The combined rate for the borough and the Camp Hill School District is 2.00% (0.50% for the borough and 1.50% for the school district). This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Camp Hill Borough also levies a Local Services Tax of $52 per year on people who work in the borough. There is an exemption for individuals with an earned income of less than $12,000 for the calendar year.

Sales Tax (Combined Rate): Cumberland County does not add a local sales tax. Therefore, the combined sales tax rate for Camp Hill remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Camp Hill, your total property tax bill is a combination of taxes from three main entities:

Cumberland County: Sets a millage rate for county services.

Camp Hill Borough: Sets a millage rate for borough services.

Camp Hill School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Mechanicsburg, Cumberland County

Mechanicsburg Livability Stats:

Suburban ● $$ ● Schools: A ● Crime: B ● Community Health: Average ● Nearby Airport ● Walkable

Mechanicsburg Homes for Sale and Rent

Mechanicsburg, Pennsylvania, offers a classic suburban lifestyle with a strong sense of community and a mix of historic charm and modern convenience. Located just west of Harrisburg, it provides a quiet, family-friendly atmosphere while still being close to the amenities of the state capital. The town's downtown area is a key feature, with a historic feel thanks to its well-preserved 19th-century architecture, which now houses a variety of local shops, restaurants, and cafes. It's a walkable and inviting space that serves as a hub for local life and events.

Life in Mechanicsburg is often defined by its balance. Residents benefit from well-regarded public schools and numerous parks and recreational facilities, which contribute to a high quality of life. The community is active, with events like the annual Jubilee Day bringing people together for a large street fair that is one of the oldest and largest on the East Coast. For those who work outside of town, Mechanicsburg's location near major highways like I-81 and the Pennsylvania Turnpike makes commuting to Harrisburg and other nearby cities manageable. This accessibility, combined with the town's welcoming atmosphere and a focus on family, makes Mechanicsburg a popular and appealing place to live.

Mechanicsburg Pines Tax Stats

Understanding the tax landscape in Mechanicsburg, Pennsylvania, involves looking at the state, county, and local levels. Mechanicsburg is a borough in Cumberland County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. A key feature of Pennsylvania's tax code is that it does not tax retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania is one of the few states with a state-level inheritance tax. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Mechanicsburg Borough are subject to a local Earned Income Tax (EIT). The combined rate for the borough and the Mechanicsburg Area School District is 1.70% (0.50% for the borough and 1.20% for the school district). This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Mechanicsburg Borough also levies a Local Services Tax of $52 per year on people who work in the borough. There is an exemption for individuals with an earned income of less than $12,000 for the calendar year.

Sales Tax (Combined Rate): Cumberland County does not add a local sales tax. Therefore, the combined sales tax rate for Mechanicsburg remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Mechanicsburg, your total property tax bill is a combination of taxes from three main entities:

Cumberland County: Sets a millage rate for county services.

Mechanicsburg Borough: Sets a millage rate for borough services.

Mechanicsburg Area School District: Sets a millage rate that funds local public schools.

The total millage rate from these three sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

Hershey, Dauphin County

Hershey Livability Stats:

Suburban ● $$$ ● Schools: B ● Crime: N/A ● Community Health: Average ● Nearby Airport ● Walkable

Hershey Homes for Sale and Rent

Hershey offers a truly unique lifestyle, unlike any other town in the region. It's a place where a major tourist destination and a quiet, family-friendly community coexist. The entire town is infused with the legacy of Milton S. Hershey, with the iconic chocolate company and its various attractions serving as the economic and cultural heart. You’ll find the streets lined with Hershey's Kiss-shaped streetlights and the sweet aroma of chocolate often hanging in the air. This connection to a single company gives the town a clean, well-maintained, and well-funded feel, with many of its top-tier amenities being a direct result of the Hershey trust.

Beyond the amusement park, the experience of living in Hershey is one of suburban comfort and convenience. The area boasts excellent public schools, low crime rates, and a variety of residential neighborhoods, making it a highly desirable location for families. The town’s landscape is a mix of quiet residential streets and bustling commercial areas, with a variety of restaurants, shops, and a vibrant arts and culture scene centered around venues like the Hershey Theatre and Giant Center. Despite the influx of tourists during peak seasons, residents enjoy a strong sense of community and a high quality of life, with numerous parks, walking trails, and recreational facilities available year-round. It's a place where tradition meets modernity, creating a sweet and inviting place to call home.

Hershey Tax Stats

Understanding the tax landscape in Hershey, Pennsylvania, involves looking at the state, county, and local levels. Hershey is a census-designated place within Derry Township in Dauphin County.

State Level Taxes:

Income Tax: Pennsylvania has a flat individual income tax rate of 3.07%. This rate applies to various types of income, including wages, salaries, interest, and dividends. Unlike some states, Pennsylvania does not have a separate tax on retirement income, such as Social Security benefits or qualifying pensions.

Sales Tax: The state of Pennsylvania has a baseline sales tax rate of 6.0%. This applies to the sale of most tangible personal property, with key exemptions like groceries and clothing.

Estate and Inheritance Tax: Pennsylvania has a state-level inheritance tax that is a significant part of its tax structure. The tax rate depends on the relationship of the beneficiary to the deceased:

0% for transfers to a surviving spouse or a parent from a child aged 21 or younger.

4.5% for transfers to direct descendants (lineal heirs).

12% for transfers to siblings.

15% for transfers to all other heirs, with some exceptions for charitable organizations.

County and Local Level Taxes:

Local Earned Income Tax: Residents of Hershey (Derry Township) are subject to a local Earned Income Tax (EIT). The combined rate for the township and the Derry Township School District is 1.00%. This tax is typically withheld from an employee's paycheck by their employer.

Local Services Tax (LST): Derry Township also levies a Local Services Tax of $52 per year on people who work in the township. There is an exemption for individuals with an earned income of less than $12,000 for the calendar year.

Sales Tax (Combined Rate): Dauphin County does not add a local sales tax. Therefore, the combined sales tax rate for Hershey remains the state rate of 6.0%.

Property Taxes: Property taxes are a significant source of revenue for local governments and school districts. In Hershey, your total property tax bill is a combination of taxes from three main entities:

Dauphin County: Sets a millage rate for county services, as well as a separate rate for the county library system. The 2025 rates are 8.376 mills for general purposes and 0.35 mills for the library.

Derry Township: Sets a millage rate for township services. The 2025 rate is 2.53810 mills.

Derry Township School District: Sets a millage rate that funds local public schools. The 2025 rate is 20.3387 mills.

The total millage rate from these sources is multiplied by your property's assessed value to determine your total property tax bill. Pennsylvania properties are assessed by the county, and the assessed value is a percentage of the property's market value.

We have put together a comprehensive guide for Pennsylvania that includes:

Information about State and Local Taxes;

Political Context and Competitiveness;

Community Overview of the Region and Neighborhoods;

Economic Opportunity and Cost of Living; diversified economy with growing opportunities;

Schools and Education;

Civic Engagement Opportunities, including political, community and advocacy organizations.

Complete the form below to access everything the Pennsylvania Guide has to offer.

By sharing your email address, you agree to receive marketing emails from PowerMoves.

By providing your cell phone number, you have provided us with consent to send you text messages in conjunction with the services you have requested. Message & Data Rates May Apply. Text HELP for Info. Text STOP to opt out. No purchase necessary.

Why Pennsylvania Represents the Future

Pennsylvania’s Congressional Districts embodies the kind of place where you can find some stability in a changing environment.

The tax climate is favorable.

Your vote genuinely matters in one of the nation's most competitive districts

Your voice can influence policy through accessible local government and civic engagement

Your life can flourish with affordable living, economic opportunity, and community connection

Your presence helps build the inclusive, competitive democracy we all need

This isn't just a place to find refuge—it's a place to build the future.